11 Feb Introducing Food for Thought: Our Event Series with Finance Isle of Man

At Innovation City, we spend a lot of time around founders, operators, and investors who are building in real time, often while navigating uncertainty, cross-border complexity, and decisions that will shape their businesses years from now.

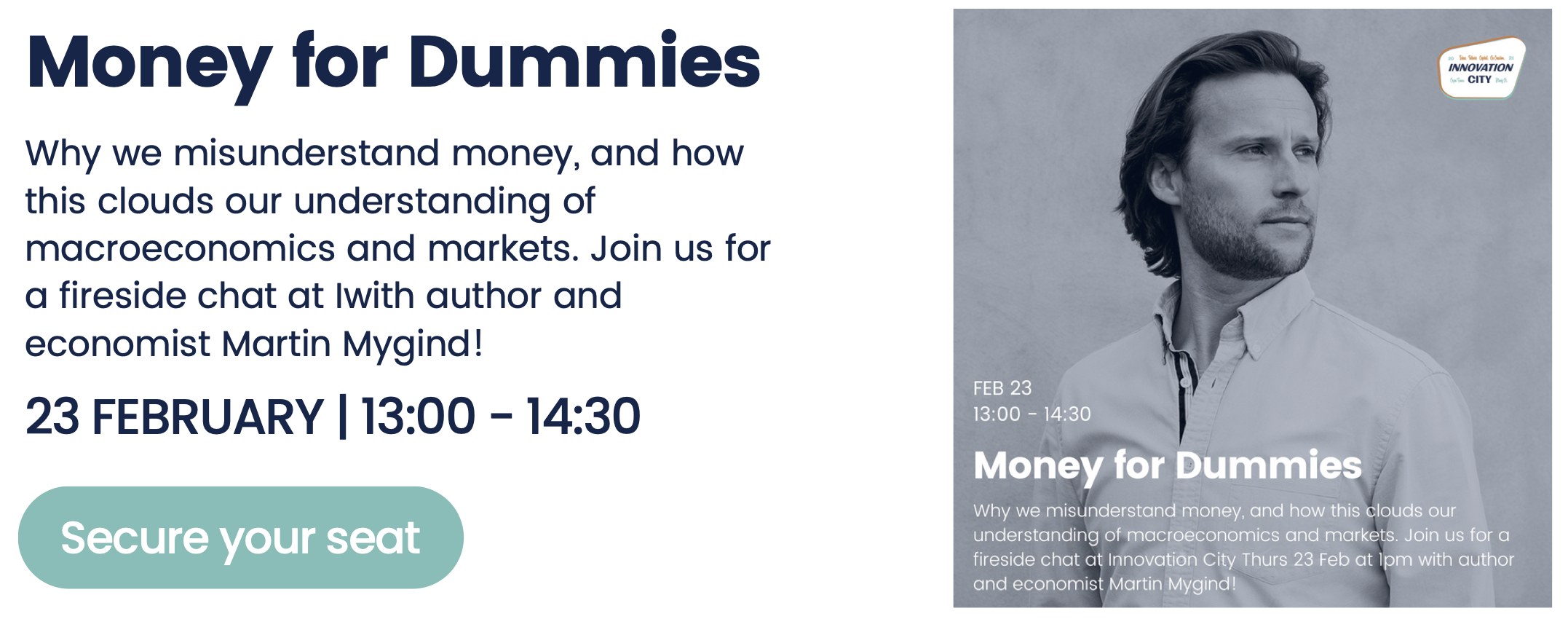

The Food for Thought series was created for exactly those moments.

Food for Thought is a programme of high-signal, founder-first conversations designed to surface clarity early, before decisions become expensive to undo. These sessions are intentionally informal, built around honest discussion rather than performance, and hosted in a setting that encourages people to stay curious, ask better questions, and think beyond the next milestone.

We’re pleased to launch the series in partnership with Finance Isle of Man, bringing global perspective into the room on topics many founders only encounter once it’s too late: international structuring, scale, data, IP, and long-term growth.

To introduce the partnership, we spoke to Cecilia Albertyn, Finance Isle of Man’s representative in South Africa, about who this collaboration is for, why now matters, and what founders should expect from the series.

Q: Who is this event series ultimately for, and which founders or businesses will get the most value from it?

This series is for founders and operators who are building with international ambition, whether they’re already operating across borders or preparing for that next phase of growth. Food for Thought is particularly relevant for founders and businesses who are thinking beyond local borders, diversify risk, raise capital or attract international investors

For businesses already servicing, or planning to service, UK, EU or other international clients, the Isle of Man can act as a highly reputable, tax-neutral platform to support internationalisation. So whether you’re preparing for your first international expansion, managing growing complexity in your corporate structure, or simply want to understand your options before you need them, the series is designed to help founders understand when these considerations start to matter, what options exist, and how to approach global structuring in a way that supports long-term growth rather than short-term optimisation.

Q: Why is Finance Isle of Man actively engaging South African founders?

We see the opportunity very clearly.

South Africa has one of the most vibrant and sophisticated entrepreneurial ecosystems on the continent of Africa producing world-class founders who are building globally competitive businesses. We’re seeing South African companies increasingly looking beyond their home market, whether that’s expanding into other African markets, Europe, the UK, or further afield. Finance Isle of Man wants to help founders build a bridge to these international markets, supported by a stable, business-friendly jurisdiction.

Many startups use the Isle of Man as a stepping stone into the UK, EU, and global investor networks. It offers a trusted route for cross-border structuring and scale.

There is also a real innovation ecosystem on the island. From FinTech and digital assets to gaming and e-commerce, the Isle of Man isn’t just open to innovation; it actively enables it through clear frameworks and government support. Founders don’t have to figure this out alone.

We already work with South African founders. More than 35 South African businesses currently have a footprint on the island, including previous winners of our Innovation Challenge. Sustainability also matters deeply to us. The Isle of Man was the first (and remains one of only two) jurisdictions designated as a whole nation UNESCO Biosphere, which attracts founders who are building with long-term impact in mind.

Finally, we want to make this easier. From company setup to legal and financial services, the island’s established support ecosystem reduces friction. Finance Isle of Man acts as a facilitator between business and government, helping founders navigate the process with confidence.

We’re engaging proactively because we believe South African founders shouldn’t have to wait until they’re facing urgent structuring challenges to learn about their options. By building these relationships and sharing knowledge early, we can be a valuable resource as companies grow and their needs evolve

Q: Where does Finance Isle of Man usually fit into a company’s growth journey?

Finance Isle of Man typically becomes relevant at several key inflection points in a company’s journey:

- Pre-international expansion: When founders are planning their first moves outside South Africa and need to consider optimal structures for multi-jurisdiction operations

- Fundraising from international investors: When bringing on international investors or funds that require particular corporate structures or vehicles

- IP and technology structuring: When centralizing intellectual property ownership or managing licensing arrangements across territories

- Data and regulatory compliance: When data flows and privacy requirements across borders become a strategic consideration

- Preparing for exit or scale: When founders need structures that facilitate eventual M&A, public listing, or significant scale

The honest answer to “when should founders start paying attention?” is earlier than most think. Many founders come to us wishing they’d understood their structuring options before they’d locked in certain decisions. Even if you’re not ready to establish international structures today, understanding what’s possible and how other successful companies have approached these challenges puts you in a stronger position when the time comes.

You don’t need to be generating millions in revenue or have international offices to benefit from this knowledge; you just need to be thinking seriously about your company’s future trajectory.

Q: Why was Innovation City the right platform for this partnership?

South Africa is producing world-class innovation, particularly in FinTech, DataTech, and CleanTech. Innovation City has built something unique in Cape Town’s tech ecosystem. It is a natural hub for founders and operators working in these spaces and thinking seriously about scale.

One of our core goals is to support South African businesses and innovators as they grow globally. The Food for Thought series creates the right environment for those conversations; early, accessible, and grounded in real experience rather than theory.

The Isle of Man is an attractive jurisdiction for companies with international clients who are expanding into European, UK, and other international markets. It also offers a flexible and robust framework for housing and protecting intellectual property, which is increasingly central to business value.

We’re not interested in just sponsoring events that are purely promotional. We want to contribute meaningfully to the South African ecosystem by supporting platforms where we can share genuine value and build lasting relationships with founders who are building the future.

Q: Why is now the right time to talk about international structuring, data, and scale, even for founders not thinking about exit?

The decisions you make early in your company’s life compound over time – for better or worse – future planning prevents costly mistakes!

Decisions made today shape what’s possible later. When founders understand international structuring early, they can make smarter choices about growth, capital, and risk.

Trusted tax-neutral jurisdictions like the Isle of Man offer advantages such as:

- Lower withholding tax

- Simplified capital and profit repatriation

- Zero corporation tax

- No capital gains tax

- No dividend tax

Beyond tax, the Isle of Man is known for clear, consistent, pro-business regulation and fiscal policy.

It’s also leading globally in how data is treated as an asset. The island is pioneering Data Foundations, allowing organisational data to be held, governed, traded, or used as collateral, similar to intellectual property. Proposed legislation aims to enable certified data to be treated as a financial instrument, which could significantly impact company valuation and M&A outcomes. There are currently no universal standards for valuing organisational data, making this a world-first initiative.

From an early stage, founders should be considering all assets that add value, including IP and data, as part of a broader growth and succession picture.

Q: If a founder attends just one Food for Thought session this year, what do you hope they leave understanding more clearly?

We want founders to leave with clarity; not necessarily answers to everything, but a stronger sense of what to think about earlier.

We’re particularly focused on emerging South African SMEs and the next generation of business leaders and investors. This group often views borders, markets, and wealth very differently to previous generations. Technology has removed many traditional barriers, but globalisation also brings complexity around regulation, currency, and tax.

Our aim is to be a trusted partner in navigating that complexity, supporting founders to build solid, internationally scalable businesses grounded in sustainable growth and mutually beneficial trade relationships.

Visit Finance Isle of Man here.